Health Business Tax Requirements 2023: What Health Professionals Need to Know

As a new health professional, navigating the complex world of self-employment tax requirements can be overwhelming. However, understanding these essential aspects is crucial for your financial success.

In this guide, we'll explore the business tax requirements you need to be aware of in 2023, including the advantages and disadvantages of incorporating your health practice and how to navigate provincial and federal tax requirements, as well as record-keeping and reporting obligations.

The first step to growing a new health business is your business registration! Snag our FREE guide to business registration and getting your business number!

Short Summary

Understand the fundamentals of income tax, deductions and credits to effectively manage finances.

Benefit from available tax deductions and credits to reduce taxable income.

Be aware of provincial/federal requirements for record keeping & reporting obligations to comply with CRA regulations.

Understanding Tax Requirements for Health Professionals

As a health professional, mastering the fundamentals of income tax, deductions, and credits is critical for managing your finances effectively. In addition, practitioners face complex financial needs, including debt repayment, billing, and expense management, as well as addressing often significant personal income taxes.

To better understand your tax requirements as a health professional, it's essential to learn about income tax basics, deductions, and credits available to you. This knowledge will empower you to make informed decisions and optimize your financial situation.

Deductions and Credits Available to Health Professionals in 2023

You can claim tax deductions for various business expenses, including automobile expenses, office furniture, annual membership fees, capital asset purchases, supplies and expenses, communication expenses, uniforms and upkeep expenses, and continuing education. When filing your taxes, make sure only to include amounts paid in the current year and not any outstanding or insurance-covered amounts.

For example, when you pay your yearly membership fees to your association or college, these expenses can reduce your taxable income for the year for your return.

Taking advantage of these deductions and credits can significantly reduce your taxable income and result in substantial tax savings.

Navigating Provincial and Federal Tax Requirements in 2023

Your provincial and federal tax requirements vary, and it is crucial to ensure compliance. In the following sections, we'll discuss how to understand provincial tax requirements and navigate federal tax requirements, ensuring that you remain compliant with all tax laws and regulations.

Understanding Provincial Tax Requirements in 2023

Your provincial tax requirements vary by province and include income tax, employer health tax, and sales tax. By being aware of these requirements and the changes made, you can make informed decisions about your financial affairs and avoid potential penalties.

In British Columbia, there have been updates to personal income tax, corporate income tax, insurance premium tax, and logging tax (source).

Nova Scotia has also announced a More Opportunity for Skilled Trades program that will refund provincial income taxes for eligible nurses under 30 years old.

Ontario also did not continue the Staycation Tax Credit for 2023, as this was a temporary one-year credit only available for 2022 only.

It is important for health professionals to stay up-to-date with these changes in order to maximize their savings.

Navigating Federal Tax Requirements in 2023

As always, corporations are required to submit a corporate income tax return and must submit it within 6 months of the end of their tax year. Once you incorporate your personal bookkeeping stops, you can no longer expense any purchases on your personal tax return. Any income you earn must go to the corporate account before it is passed on to you as salary or dividends.

2023 is bringing several important federal tax updates for health professionals in Canada.

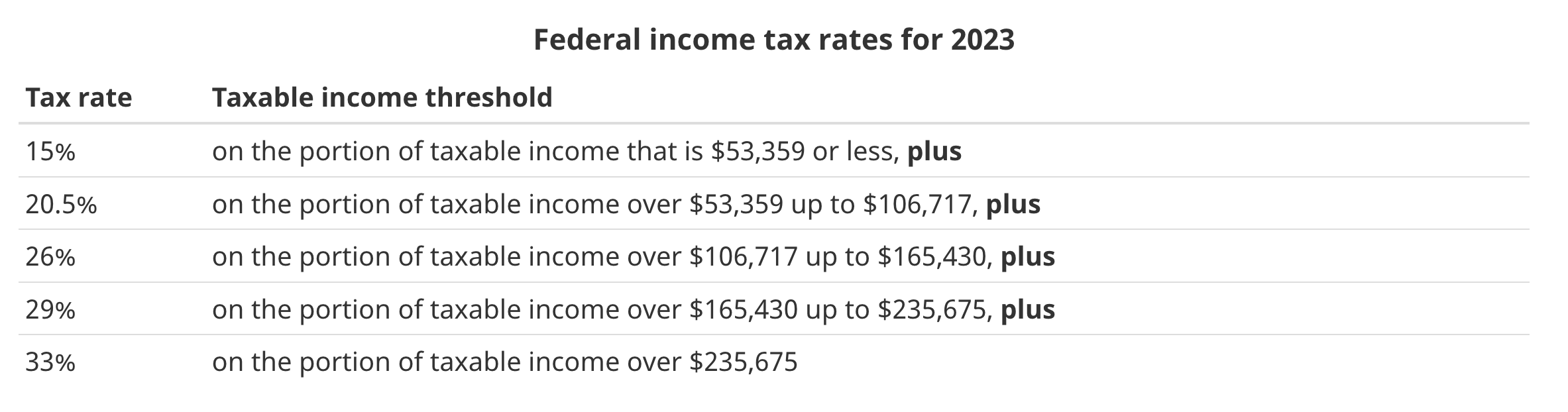

Income Tax Brackets in 2023

Individual taxpayers can earn more in 2023 than in 2022 without increasing the percentage of income tax they pay, with the 2023 Income Tax Brackets increasing by 6.3%.

RRSP 2023 Dollar Limit

The 2023 Registered Retirement Savings Plan dollar limit is $30,780, up from $29,210 in 2022 (CRA).

TFSA 2023 Dollar Limit

The 2023 Tax-Free Savings Account dollar limit is $6500 in 2023, up $500 from 2022 (CRA).

Working with an accountant for your annual corporate income tax return is highly recommended. They will provide a list of annual adjusting entries to ensure that the tax-related impact on your return is accurate. It is important to understand and adhere to federal tax requirements in order to remain compliant and avoid potential penalties.

Record-Keeping and Reporting Obligations for Health Professionals

Accurate record-keeping and reporting are essential, and having a professional bookkeeper and accountant from the start can help ensure that all records are kept up-to-date and accurate. An experienced bookkeeper and accountant on hand can help you better understand your financial obligations and maximize your resources.

Good record-keeping also helps you stay compliant with regulatory requirements, which can save them time, money, and potential legal issues in the long run. In the following sections, we'll discuss the essential financial records to maintain and the reporting requirements and deadlines for health professionals to ensure compliance and avoid potential penalties.

Essential Financial Records to Maintain

The essential financial records to maintain for a health business include the balance sheet, income statement, and cash flow statement. Additionally, it is important to have your profit and loss statement, tax return, and aging reports.

A balance sheet outlines your company's assets, liabilities, and shareholder's equity as of a specific point in time. An income statement outlines your company's revenues, expenses, and profits over a specified period of time. A cash flow statement outlines your company's cash receipts and disbursements over a designated period of time.

By maintaining these essential financial records, you can ensure that your financial affairs are in order and that you have accurate records for tax and reporting purposes.

Reporting Requirements and Deadlines in 2023

Staying up to date with reporting requirements and deadlines is crucial for you to avoid potential penalties and ensure compliance. Below is a list of important deadlines for 2023:

When to file taxes

T1: Personal Income tax return - payment deadline April 30, 2024, and filing deadline June 15, 2024

T2: Corporate Income tax return -payment deadline 3 months after fiscal year-end and filing deadline 6 months after fiscal year-end

T3: Trust Return - April 1, 2024

T4 Employee Income Slips - February 29, 2024

T4 Dividend and Interest Slips - February 29, 2024

The GST/HST deadlines in 2023 - annual filers with December 31 year-end must pay by April 30, submit a return by June 15

By adhering to these requirements, you can focus on providing exceptional care to your patients while maintaining a solid financial foundation.

Know Your Health Business Tax Requirements

Understanding tax requirements, incorporating your health practice, and managing Health Spending Accounts (HSAs) and Private Health Services Plans (PHSPs) is essential to ensure your financial success. With this guide in hand, you are well-equipped to make informed decisions about your financial future and thrive in your health practice.

Take the first step towards financial mastery by enrolling in Business Foundations: The Online Course For New Health Professionals To Understand Your Business Finances And Tax Requirements now!

Frequently Asked Questions

How much can a sole proprietor business make before paying taxes in Canada?

In Canada, small business owners can make up to $ 15,000 before they are required to pay taxes. This is the basic personal amount set by the CRA, which is adjusted annually.

Therefore, small business owners should stay up-to-date with any changes for 2023 or beyond.

What is considered professional income CRA?

Professional income is any income that comes from a profession that requires licensing and certification, such as a lawyer, doctor, dentist, or accountant.

The Canada Revenue Agency (CRA) looks at professional income differently than other forms of income, taxing it at a higher rate.

What is a T2125 professional income?

A T2125 Professional Income is an income that is earned from self-employment activities. The T2125 Form, or the Statement of Business or Professional Activities, is used to report these incomes and expenses in order to calculate your gross and net income for your Federal Income Tax and Benefit Return.

What is the medical expense threshold CRA?

The medical expense threshold, set by the Canada Revenue Agency (CRA), is 3% of your net income or $2,479 in 2022 ($2,635 in 2023), whichever is lower. You can also claim the disability amount and up to $10,000 for these expenses ($20,000 if the person died in the year).

For residents of Ontario, the provincial limit is up to $15,407 ($30,813 if the person died in the year).